Michał Smyczek

CFO, Cledar

Cledar helps a leading global credit rating agency evolve its client-facing software to enhance monitoring and analysis of structured finance portfolios.

Country

USA

Industry

Financial Services

Duration

2019 - Now

Our client, a leading global credit rating agency, offers its users a number of solutions to manage their investments. One of these is a web-based platform that provides access to a suite of data visualization and analytics tools to help finance professionals and investors manage their cashflows, regulatory metrics, and more. During the course of a multi-year relationship, Cledar has been involved in the development of several subproducts that have been integrated within the client’s core solution to make the monitoring and analysis of the structured finance portfolios easier and more accurate.

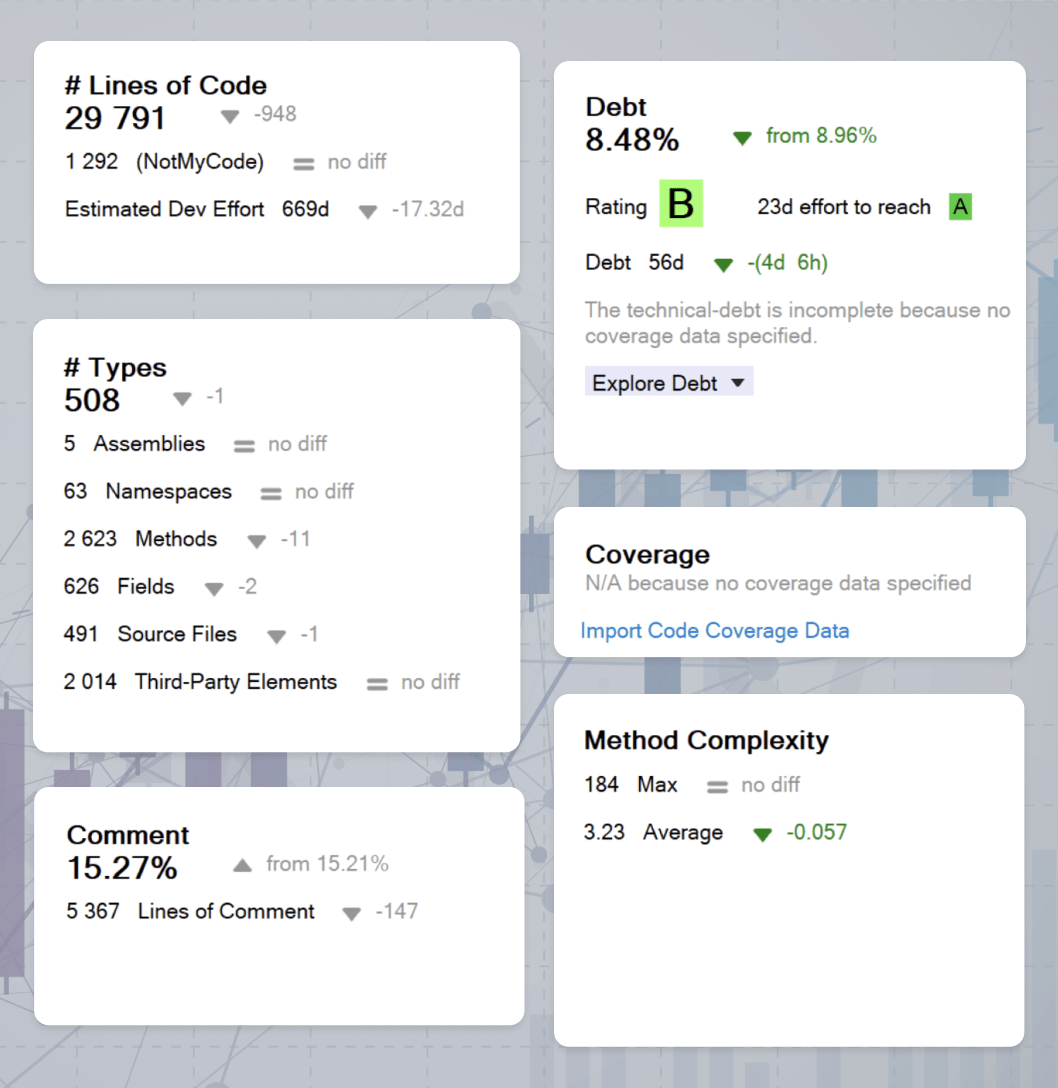

We helped reduce technical debt from 20.35% to 8.48%

Up from 0 after introduction of unit tests

Down from 9.51, despite an increase in lines of code

Our client was looking for a partner to improve the underlying architecture, stability and performance of one of its key client-facing solutions. Being a niche segment of the financial services industry, where trust, security, and accuracy of data are non-negotiable, the key challenge was to gain a full understanding of the securitization process and our client’s service offering in order to properly address the complex business needs. Our client was looking for a long-term technology partner that could integrate with the client’s corporate structure and help simplify and add value to its suite of structured finance products.

From the technical perspective, there was a need to work with (and modernize) monolithic and complicated on-premise legacy applications that were supported by very limited technical and business documentation. This resulted in excessive effort being required for routine maintenance and bug–fixing tasks, and it made it hard to automate testing. The architecture of the platform made it difficult and cost-prohibitive to evolve or introduce new and value-adding innovations. A second major technical challenge was the exceptionally large – and growing – volume of data and number of data sources, both of which threatened to stretch existing infrastructure capacity and drive up cost.

To overcome the issues related to effort-intensive testing and unknown codebases, we took the initiative to refactor the application’s codebase. This enabled us to stabilize the application and create appropriate business and technical documentation for it.

In order to make better use of the technology available to us and to provide our client with more options and development directions in the future, we made use of cloud-based solutions (including designing cloud-based pipelines for collecting and visualizing statistics of solution usage), wherever possible.

We also integrated Single-Sign-On (SSO) features to improve security, built a new Auto Updates feature for Excel AddIn to enable accurate, near-real-time views for customers, and we also enhanced data visualization capabilities to provide a better, more-insightful experience for end users.

Cledar continues to work with this leading credit agency with developers and engineers supporting multiple client teams around the world. The application – with refactored code – has been migrated to the cloud.

Thanks to the modernized code base and use of best-in-class APIs, the application can now handle the growing volumes of data more quickly and cost effectively, and testing has been automated, thus cutting down the amount of time and effort spent on maintenance, development, and testing, and improving the overall quality of the application.

Supported by up-to-date documentation, a constantly evolving cloud platform, and Continuous Integration, the client can now evolve its solutions and add new features and functionalities quickly and cost effectively to anticipate and meet the needs of its customers and provide them with an insight-rich, intuitive user experience. Updates can now be rolled out once a month, instead of once every six months.